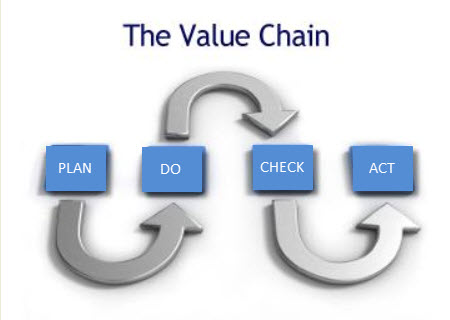

Good Auditing Practice Converts A Supply Chain Into A Value Chain

There is often some confusion about the difference between the traditional supply chain and what has come to be known as a “value chain”. In reality, the two usually overlap and can even be the same “chain”. The difference lies in the high-level view of the process, but it can be argued in most cases – if not all – that a supply chain that isn’t also a value chain is a sign of poor business practices.

Today we look at creating a value chain for business, and how effective auditing is just as important as ownership for each link in the chain.